Marginal Tax Rates 2025 Australia

Marginal Tax Rates 2025 Australia. Tax payable on income you receive, if you're under 18 years old and not an excepted person with excepted income. Use these tax rates if you are an individual and were a foreign resident for tax purposes for the full year.

What your take home salary will be when tax and the medicare levy are removed. Under the federal government’s changes to the stage three tax cuts, employees earning between $45,000 and $135,000 will now face a marginal tax rate of.

We have now calculated our effective tax rate and marginal tax rate on our annual taxable income of $ 100,000.00 in australia for the 2025 tax year and can compare the.

Australia Marginal Tax Rates 2025 Printable Online, Use these tax rates if you are an individual and were a foreign resident for tax purposes for the full year. Here are some tables setting out the current rates for 2025/24 and 2025/25 and also what that means in terms of tax payable.

Marginal Tax Rates Chart For 2025, What your take home salary will be when tax and the medicare levy are removed. Set to take effect from 1 july 2025, the australian taxation office (ato) has announced significant amendments to the marginal tax rates.

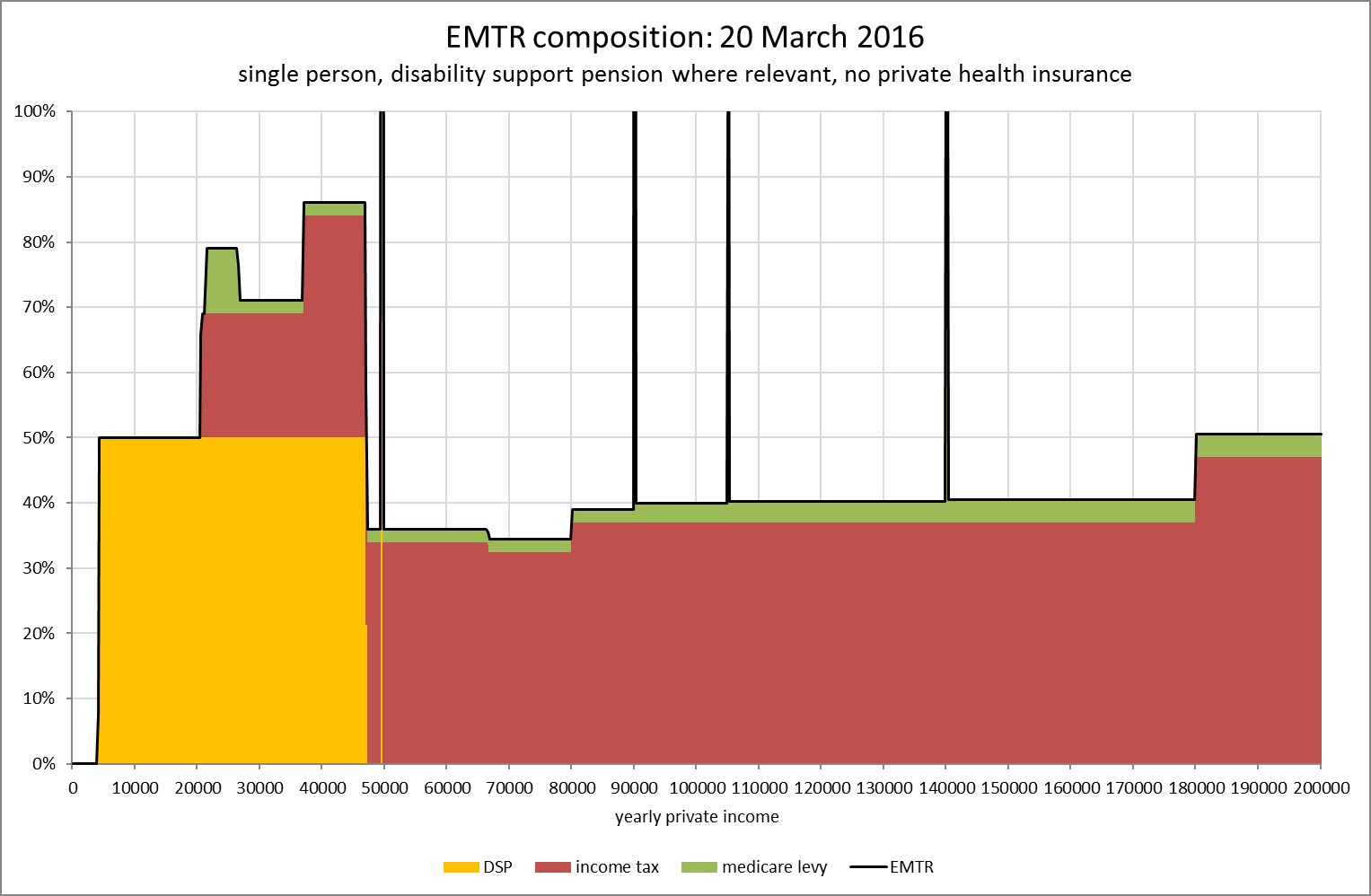

Figure8 Austaxpolicy The Tax and Transfer Policy Blog, Use these tax rates if you are an individual and were a foreign resident for tax purposes for the full year. This simplified ato tax calculator will calculate your annual, monthly, fortnightly and weekly salary after payg tax deductions.

Australian Tax Rates 202425 Elisha Chelsea, The threshold above which the top 45% tax rate applies increases from $180,000 to $190,000. About foreign resident tax rates.

Tax rates for the 2025 year of assessment Just One Lap, On 25 january 2025, the government announced changes to individual income tax rates and thresholds from 1 july 2025. How much australian income tax you should be paying.

Marginal Tax Brackets For Tax Year 2025 Eve Harriott, Here are some tables setting out the current rates for 2025/24 and 2025/25 and also what that means in terms of tax payable. A cut in the 19% tax rate to 16%, saving $804 for those on taxable incomes of $45,000;

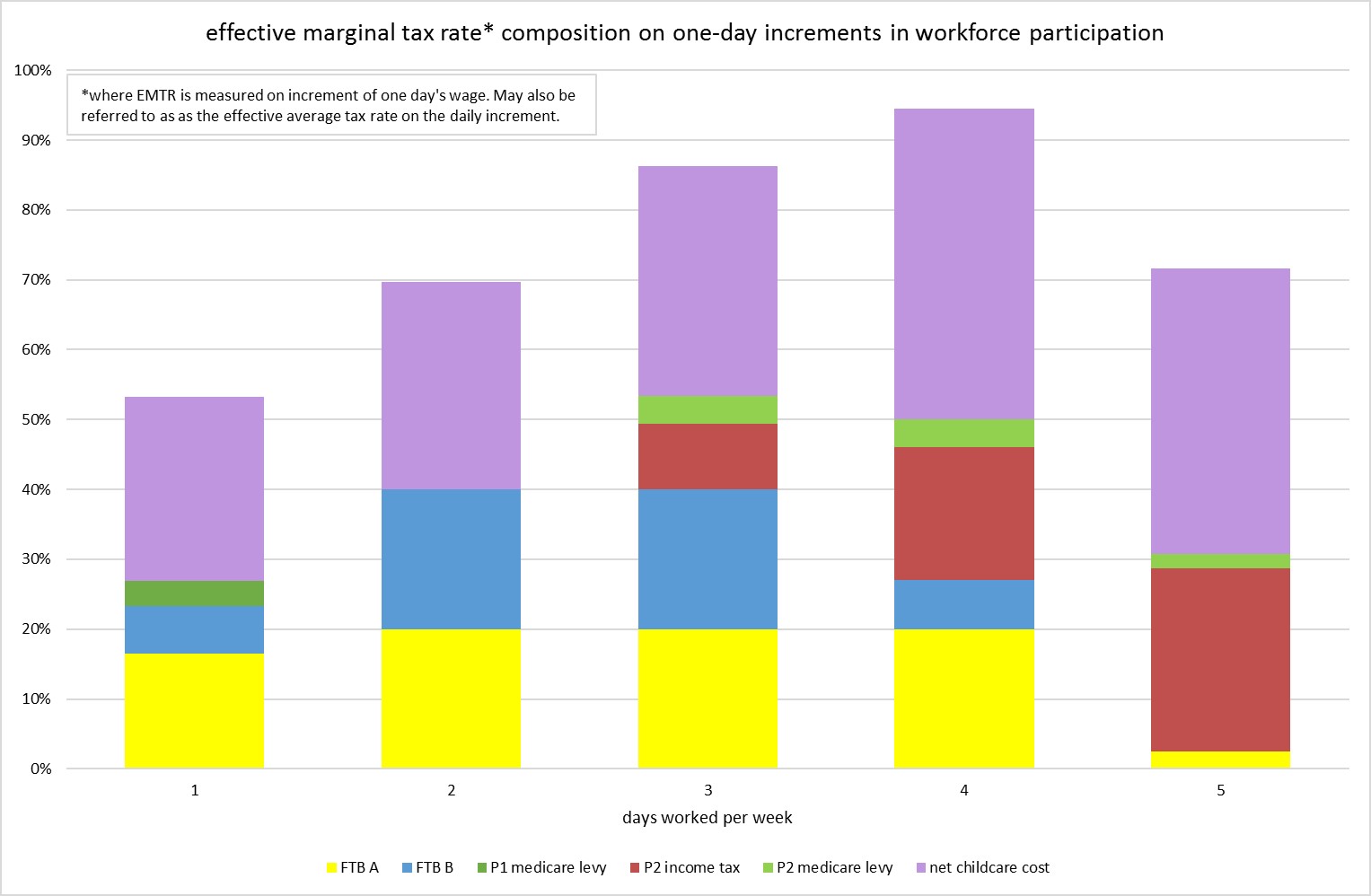

Effective Marginal Tax Rates Part 2 Austaxpolicy The Tax and, Use these tax rates if you are an individual and were a foreign resident for tax purposes for the full year. Please enter your salary into the annual.

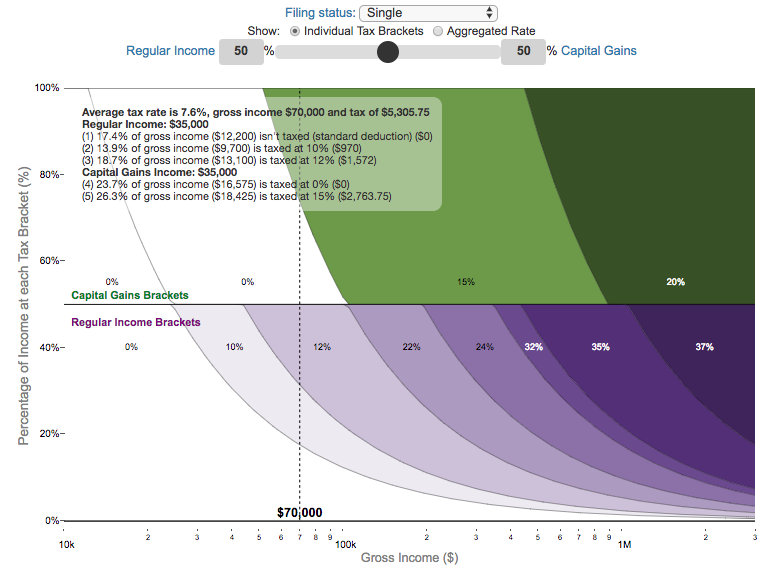

Visual Guide to Understanding Marginal Tax Rates Engaging Data, Here are some tables setting out the current rates for 2025/24 and 2025/25 and also what that means in terms of tax payable. What your take home salary will be when tax and the medicare levy are removed.

2025 Tax Code Changes Everything You Need To Know, Tax rates if you're under 18 years old. How much australian income tax you should be paying.

How Do Marginal Tax Rates Work — and What if We Increased Them?, Australian resident tax rates 2025 to 2025. The financial year for tax purposes for individuals starts on 1st july and ends on 30 june.

We have now calculated our effective tax rate and marginal tax rate on our annual taxable income of $ 100,000.00 in australia for the 2025 tax year and can compare the.